The Yes Bank Collapse: Modi’s Economic Mismanagement Continues to Play Havoc

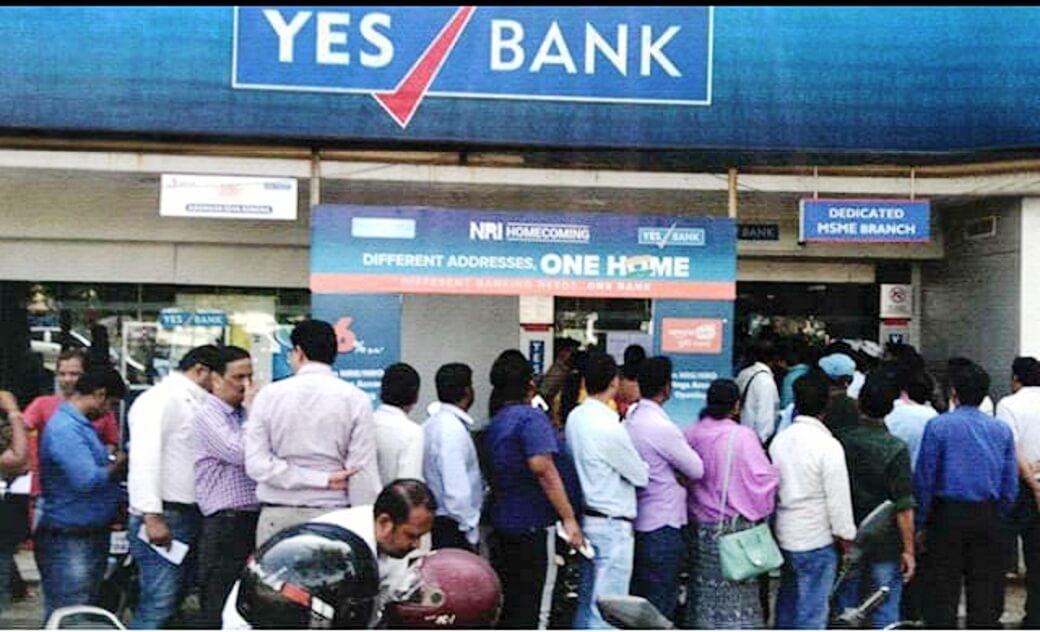

YET another bank has collapsed in the Modi regime. Yes Bank, the latest Indian bank to have been declared sick and unviable by the RBI, is India’s fifth largest private bank after HDFC, ICICI, Axis Bank and Kotak Mahindra. While the Finance Minister assures depositors that their money is safe, the RBI has placed a cap on withdrawal of money from the bank causing immense hardship to all depositors in need of immediate cash. The Yes Bank collapse comes in the wake of a similar crisis in the Punjab and Maharashtra Cooperative Bank late last year, but in terms of magnitude this is way bigger and fraught with ominous implications for the entire banking sector.

The Yes Bank collapse is a classic example of all that is wrong with the Modi government’s economic policy and management. On the face of it the Yes Bank has collapsed under the weight of mounting NPAs. Non Performing Assets, the official term for mega loans not being repaid, mostly by big corporates, is a common problem affecting almost the entire spectrum of India’s big banks, but the saga of the Yes Bank is exceptionally astounding. The bank was formed in 2004, its promoters tussled among themselves over control and one of its founders, Rana Kapur, is currently arrested on charges of money laundering. He is also known to have bought a Rajiv Gandhi portrait done by MF Hussain from Priyanka Gandhi Vadra for a sum of Rs 2 crore. The propagandists of the Modi regime would thus like to project Rana Kapur as being close to the UPA regime and blame his wrongdoings for the entire crisis.

This does not at all hold water. The fact is the bank’s loans jumped precisely in the Modi years from Rs 55,633 crore in March 2014 to Rs 2,41,499 crore in March 2019. More intriguingly, the loans grew by more than Rs 1,00,000 crore in the post-demonetisation period when the investment outlook has been pretty bleak and business has been down and dull in almost all sectors. This happened even when the bank was reportedly under the watch of the RBI and the Finance Ministry. More intriguingly, in November 2019 Rana Kapur managed to sell all his shares in the bank, thereby virtually moving out of the bank. It is the RBI and the Finance Ministry which owe an answer to the people as to how the bank was allowed to accumulate such bad loans.

The bad loans extended by the bank have big corporate names close to the current regime. Forty four companies from ten big groups account for Rs 34,000 crore loans from the bank. At least nine companies of the Anil Ambani group account for as much as Rs 12,800 crore while 16 companies from Essel group (the media conglomerate controlled by Subhash Chandra, the founder of Zee TV) have pocketed Rs 8,400 crore. It is the same Anil Ambani who had been given a major share in the Rafael deal scam signed by Narendra Modi, and Zee has been virtually a media wing of the Modi regime. It is also instructive to note that several Gujarat based companies, including the Adani group, withdrew huge amounts of money from the Yes Bank just before the RBI imposed the March 5 embargo on cash withdrawals from Yes Bank.

The crisis of the Yes Bank is thus rooted squarely in the current policy environment of privatisation and liberalisation which has promoted indiscriminate privatisation as a recipe for efficiency and growth coupled with the growing culture of crony capitalism where the institutional framework of operational transparency and financial accountability has been completely subordinated to the whims and narrow interest of the dominant nexus between big business and state power. And this nexus has never been as brazen and aggressive as under the current regime.

The measure announced by the RBI to save the Yes Bank is liable to further deepen and spread the crisis. The SBI is being pressed into service to bail out the bank by buying its shares – it has been directed to invest Rs 2,450 crore to acquire a 49-percent stake at a time when the bank shares have lost all value. Earlier the LICI was forced to bail out the IDBI in a similar fashion. This is an utterly unacceptable diversion of public funds, a classic case of nationalisation of loss and privatisation of profit. The government and the RBI should ensure immediate recovery of the so-called bad loans. The Yes Bank collapse must be seen as a wake-up call to save India’s banking sector by reversing the present policy of privatisation and restoring the autonomy and institutional integrity of the RBI.

It should also be noted that the present crisis has exacerbated in the wake of demonetisation when common people were forced to deposit all their money in banks even as mega corporate defaulters were allowed to flee the country or patronised with more doses of ‘bad loans’. The time has surely come to fix the political accountability for this massive mismanagement of the economy.

Charu Bhawan, U-90, Shakarpur, Delhi 110092

Phone: +91-11-42785864 | +91 9717274961 E-mail: info@cpiml.org